Key Takeaways

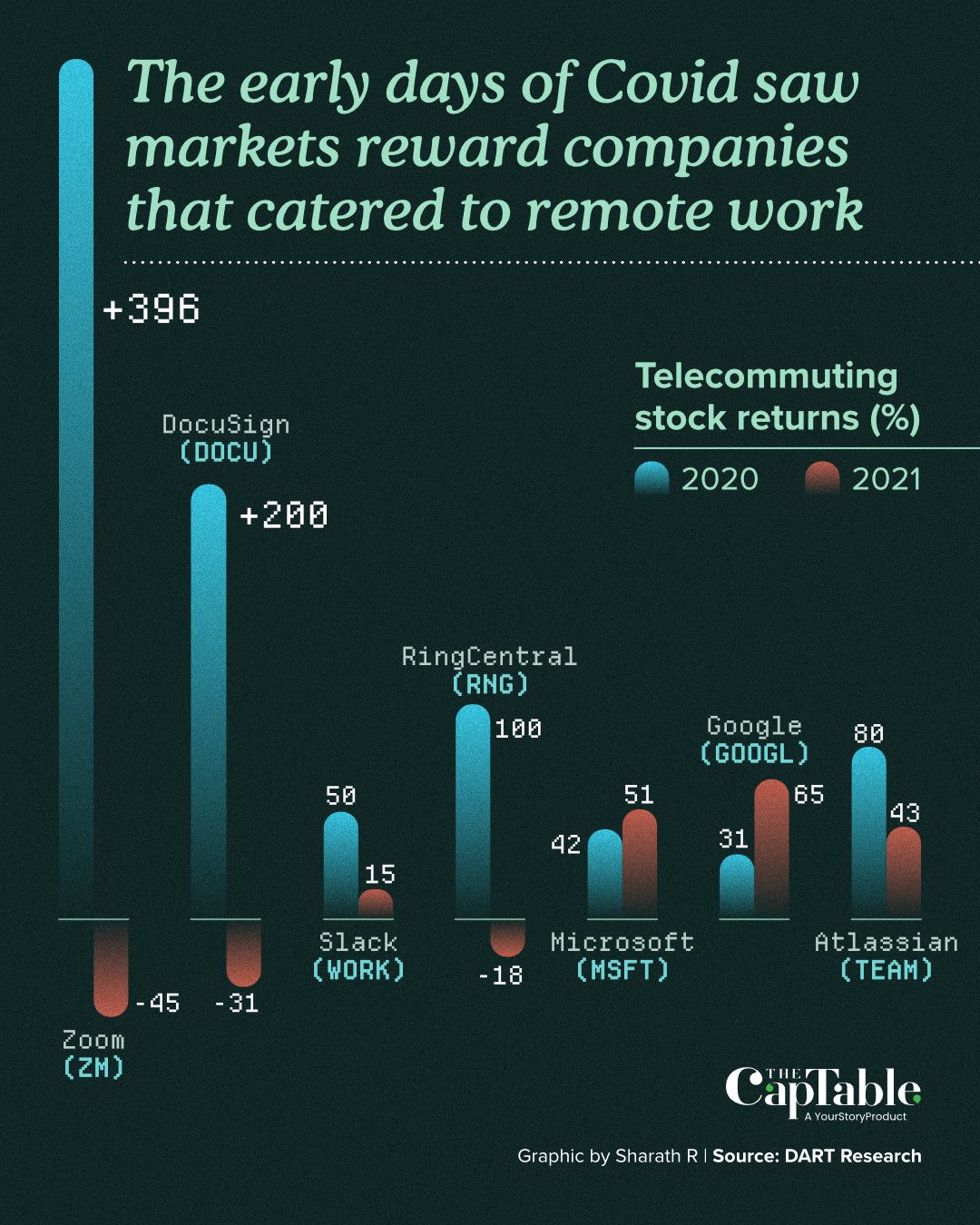

In April 2020, when the world was still getting used to the idea of lockdowns and quarantines, the stock markets found new favourites. At the time, anything that enabled video conferencing and remote work collaboration—think Zoom, Slack, Microsoft, Cisco, Atlassian, RingCentral, and Dropbox—saw their fortunes rise.

Notably, the jump in the share price of Atlassian through 2020 was more than 2X that of Microsoft, with it usually trading at 5 times the price-to-earnings (PE) ratio of both Microsoft and Google during that period. RingCentral and Slack were not even profitable at the time, and Zoom barely so. However, the market sentiment of not being left behind during a generational shift in work patterns meant that no one was willing to give up on the chase.

A year later, the same set of stocks demonstrated a very different behaviour. Stocks that rode the tailwinds of telecommuting and remote work, which were up 128% in 2020, were up just 11% in 2021. The 2021 performance hid significant dispersion in performance.

Instead, platform plays with diversified revenue streams (Google, Microsoft, and Atlassian) continued to rise, whereas one-trick ponies such as DocuSign, RingCentral, and Zoom landed hard on their backs. Company narratives had overtaken industry themes.

Things are not always so clear-cut when one looks at pricing behaviour. The Covid years were exceptionally choosy when it comes to narrative preferences. However, at any point in time, price behaviour in a sector is some combination of what people think about specific companies and what they perceive for that industry overall.

At any time, the commentary around share prices in an industry can be divided into two components. The first explains price movements in a stock in an industry due to industrywide factors. And the other, which explains price movement in a stock driven by company-specific stories. On any day, the perceptions around a company are some combination of these two factors.

The component of the commentary that dominates is important. When sector-wide narratives dominate, there is little to distinguish between a well-run firm and a bad one—everyone rises and falls together. When company-specific ones do, it becomes possible to emphasise a well-run firm and position it at a premium over its peers.

Already a subscriber? Sign In

Be the smartest person in the room. Choose the plan that works for you and join our exclusive subscriber community.

Premium Articles

4 articles every week

Archives

>3 years of archives

Org. Chart

1 every week

Newsletter

4 every week

Gifting Credits

5 premium articles every month

Session

3 screens concurrently

₹3,999

Subscribe Now

Have a coupon code?

Join our community of 100,000+ top executives, VCs, entrepreneurs, and brightest student minds

Convinced that The Captable stories and insights

will give you the edge?

Convinced that The Captable stories

and insights will give you the edge?

Subscribe Now

Sign Up Now